Investors

An industry-leading copper portfolio of high-quality and low-cost assets.

Unparalleled Copper Portfolio

Advanced development and cash-flowing assets in the lowest cost quartile of total cash costs curve

Word-Class Funding Partner

Sandstorm Gold Royalties is one of the largest royalty companies in the world

Financial Leverage with Favourable Terms

Below market debt interest rates and non-dilutive conversion features

TSX-V: HCU

Multi-Decade Cash Flowing Assets

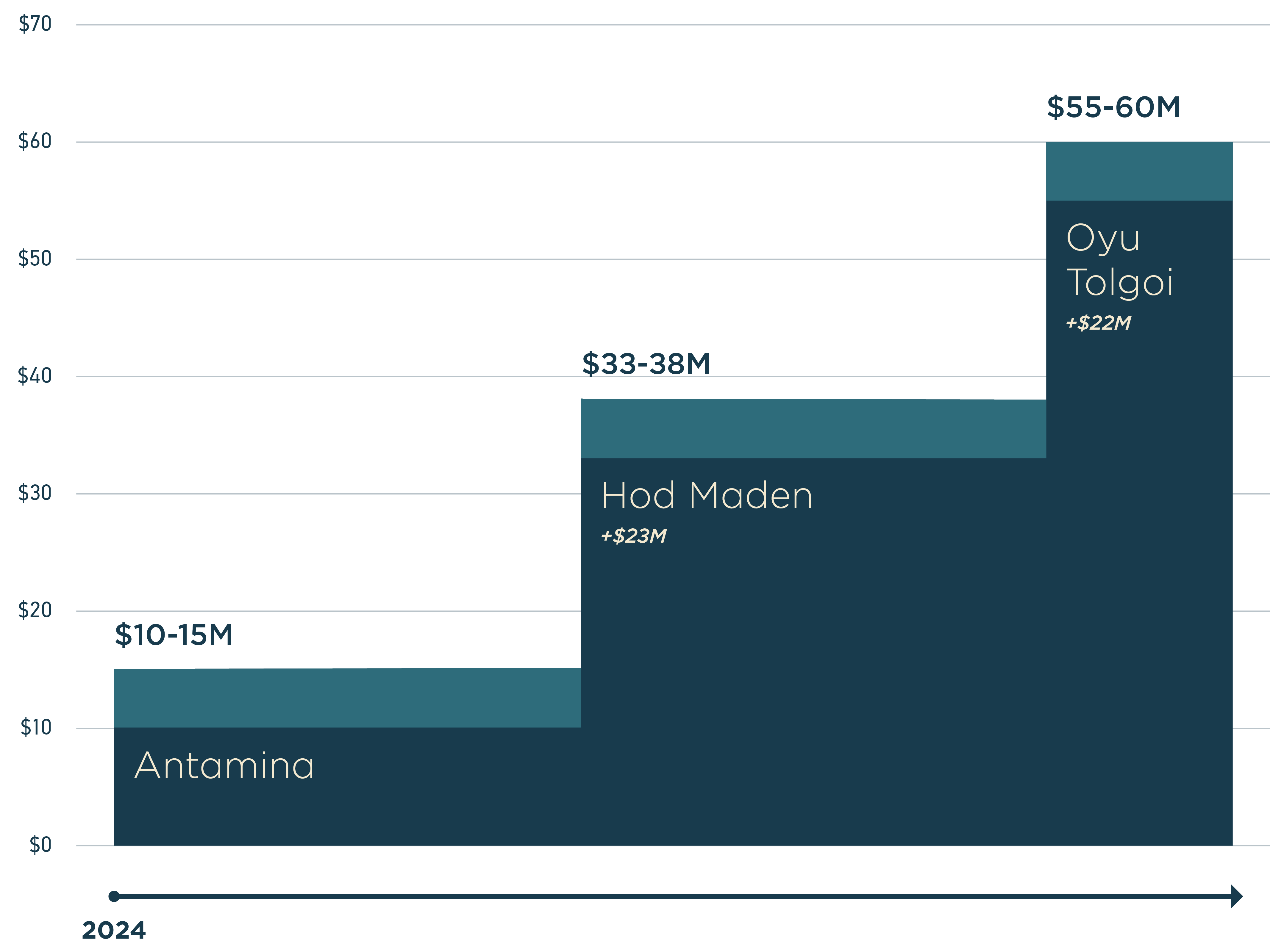

AVERAGE ANNUAL CASH FLOWS1 (US$ MILLIONS)

Price Assumptions: $3.80/lb Copper, $1,800/oz Gold

1. Estimated average cash flows or dividend payments net of respective streams and royalties (Antamina Ag Stream, Antamina Residual Royalty and Hod Maden Gold Stream payable to Sandstorm).

Multi-Decade Cash Flowing Assets

Horizon’s inaugural portfolio consists of a collection of world-renowned, low-cost copper mining projects that are expected to generate cash flow for multiple decades. With one asset cash-flowing today, and two others in development, Horizon’s portfolio has impressive growth built in and provides investors leverage to increasing commodity prices.

Horizon’s inaugural portfolio consists of a collection of world-renowned, low-cost copper mining projects that are expected to generate cash flow for multiple decades. With one asset cash-flowing today, and two others in development, Horizon’s portfolio has impressive growth built in and provides investors leverage to increasing commodity prices.

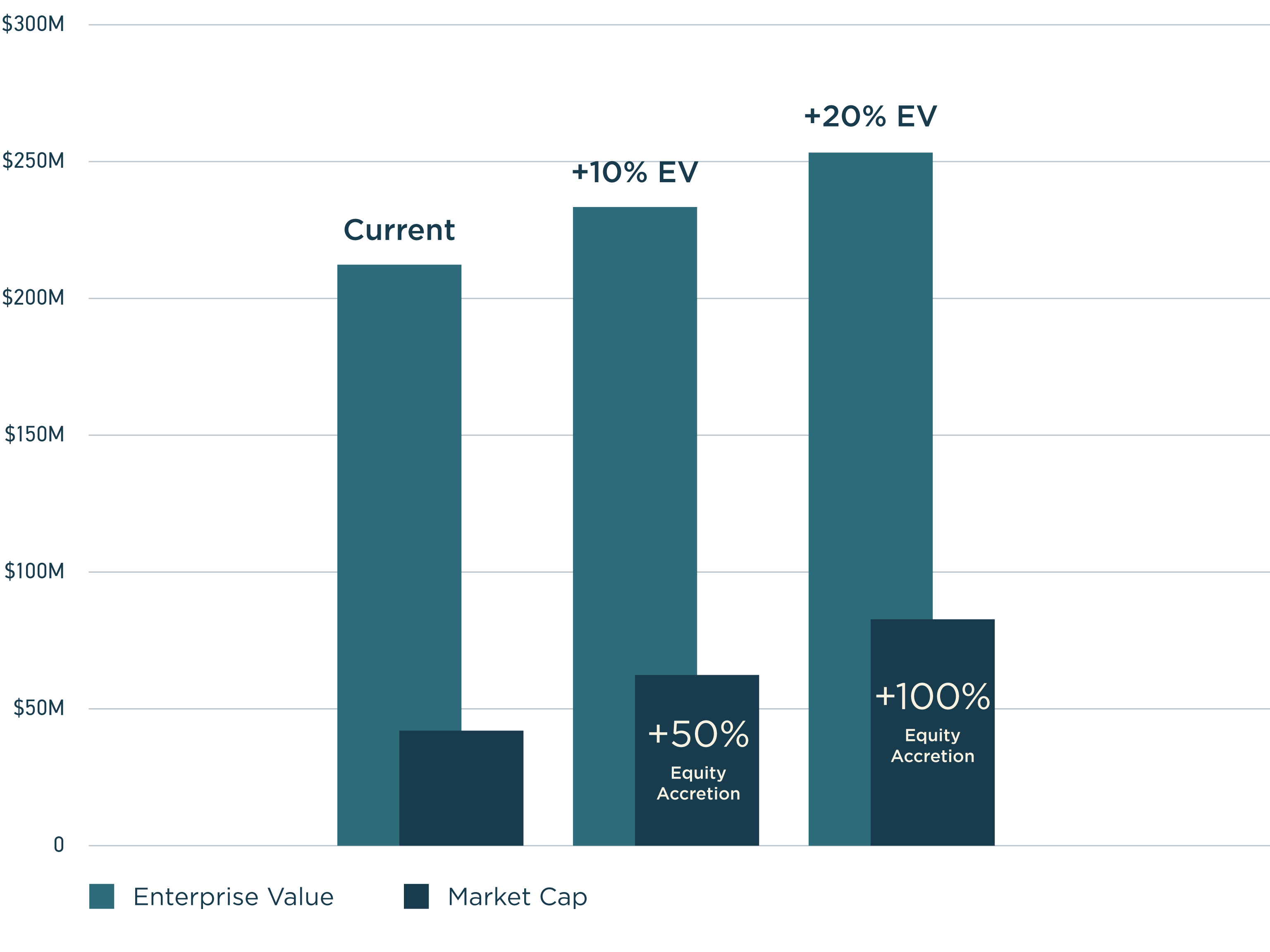

Tremendous Torque through Leverage

Tremendous Torque through Leverage

Horizon has a unique capital structure2 made possible by its strategic partnership with Sandstorm Gold Royalties. Through the use of friendly debt on favourable terms, including below-market interest rates, Horizon has acquired a truly extraordinary copper portfolio while maintaining a relatively small market capitalization. As this portfolio develops, any increases in the Company’s valuation will be directly accretive to equity holders. In fact, for every 10% increase to Horizon’s Enterprise Value, it is expected that equity will increase by approximately 50%.

2. See Company’s capital structure below

Horizon Copper Valuation

Horizon has a unique capital structure2 made possible by its strategic partnership with Sandstorm Gold Royalties. Through the use of friendly debt on favourable terms, including below-market interest rates, Horizon has acquired a truly extraordinary copper portfolio while maintaining a relatively small market capitalization. As this portfolio develops, any increases in the Company’s valuation will be directly accretive to equity holders. In fact, for every 10% increase to Horizon’s Enterprise Value, it is expected that equity will increase by approximately 44%.

2. See Company’s capital structure below

Multiple Routes to Re-Rating

Horizon is a growth company with an exceptional portfolio right out of the gate. Over the coming years, we expect multiple re-rating opportunities, including:

- Leverage to increasing copper prices

- Increased scale from future acquisitions

- Hod Maden re-rating upon construction and development milestones

- Hugo North advancements and first cash-flows

Unparalleled Copper Assets

Horizon’s portfolio of exceptional copper mining assets is the right foundation for the Company to grow and expand its operations. Learn more about these incredible assets.

Explore ProjectsHorizon in the Media

Watch recently posted Horizon Copper news stories, interviews, and video content to make sure you don’t miss a beat. Visit Horizon Copper’s YouTube Channel for more videos.

VaLPAL

Horizon Copper: Investment Case

President & CEO, Erfan Kazemi joins ValPal to discuss Horizon Copper’s portfolio of world-class assets, the future of copper in the energy transition and what sets Horizon apart from other copper companies.

Capital Structure

| Market Capitalization | US$41M |

| Sandstorm Debentures | US$192M |

| Sub Total | US$233M |

| Less Cash & Receivables | US$21M |

| Enterprise Value | US$212M |

As at December 31, 2023. Sandstorm Debentures measured at fair value.

Friendly Debt with Below Market Terms

Terms of Debt1

-

Below market interest rates.

Horizon’s combined All-in interest rate is below 2% until the Hod Maden mine reaches production, after which, the combined interest rate is anticipated to be approximately 4% -

Long term debt with interest holiday on development assets.

Each debenture is payable over a 10-year term. The Hod Maden debenture includes an interest holiday period until the mine is in production. -

Payable in shares at market price.

Horizon holds the option to pay its debt balance in common shares at market price2, allowing the Company to leverage higher share prices in the future. -

No financial covenants.

Unlike many traditional debt facilities, Horizon’s debentures carry no financial covenants.

1. Refer to Horizon’s press releases dated July 26, 2022, and June 15, 2023.

2. Provided that Sandstorm’s ownership of Horizon does not exceed 34%.

Financials Results

For all previously reported financial results, please refer to Horizon Copper’s SEDAR+ issuer profile at www.sedarplus.ca

AGM and Corporate Materials

Horizon Copper held its Annual General Meeting of Shareholders on Friday June 9, 2023 in Vancouver, British Columbia, Canada. The date of the 2024 Annual General Meeting of Shareholders has not yet been announced. Meeting materials from the 2023 AGM are available as viewable PDFs in the links below, along with the Annual Information Form for the year ended December 31, 2023.